Early in 2017, the UK Government called for evidence and views on how to move the UK to a smarter and more flexible energy system. They received over 200 responses and I am informed that the vast majority related to energy storage.

The UK Government took the views into account and have produced a plan of 29 actions that BEIS, Ofgem, and industry will take for the future of the UK energy system called: Upgrading Our Energy System: Smart Systems and Flexibility Plan. I’ve sketched out some of my main thoughts on the document below.

Introduction of an energy storage licence to UK grid code

Tantalisingly, the UK Government plans to recognise the overwhelming noise from industry and amend the Electricity Act 1989 to include a definition of storage, but frustratingly only as a subset of the generation asset class. It will be based on the Electricity Storage Network definition and Ofgem will begin consulting on this in the summer of 2017.

The licence changes will allow storage to be exempt from final consumption levies and will de-risk investments that co-locate alongside renewables. Ofgem will improve the connections process and will use financial incentives to make the DNOs do more to help their customers.

In some ways, it is great news that the Government is finally making this move. However, by merely adding it as a sub-set of generation instead of making it a separate asset class, I interpret this solution as a bit of a bodge-job.

Creating a separate asset class would have opened up a much deeper discussion about which organisations can own the asset (i.e. can DNOs? Can National Grid?). By not creating a separate class, it seems that this vital conversation is off the cards entirely. Indeed this is consistent with Ofgem’s view (plainly reiterated in the document) that “network companies should not own or operate storage”, as they think it will “impede the development of a competitive market for storage and flexibility services”.

In my mind, this is the wrong conclusion. For me, DNOs are the perfect customer for energy storage assets. They already own the wires on the network that do the spatial arbitrage of taking energy from places of low price (supply) to places of high price (demand). Surely it follows that DNOs should be trusted to do the same with the temporal arbitrage that storage provides?

If DNOs will be continuing to make decisions about investing in the capital equipment of wires, transformers, and the rest, then surely they should be allowed to own storage at the same time, as it is being lined up as a potential rival for these traditional assets ( one of the major touted benefits of storage being “Transmission and Distribution Upgrade Cost Deferral”)?

Removal of other barriers to energy storage and Demand Side Response (DSR)

Apparently, Ofgem has already consulted on a proposed Targeted Charging Review (TCR). The consultation stated Ofgem’s views that storage should only pay one set of balancing system charges (not two as currently) and that storage should not pay the “demand residual” element of network charges at transmission and distribution level. This is obviously a sensible move as it removes a major source of unfairness and will make the business case for storage projects a lot healthier.

Ofgem are looking at giving aggregators access to the Balancing Mechanism (BM) and clarifying the rules for DSR and energy storage to participate non-exclusively in the Capacity Market (CM). This is really great news for the UK energy market. Firstly, clarification of the CM rules will finally allow the much-talked-about revenue stacking that underpins almost all energy storage projects.

Secondly, allowing aggregators access to the BM will boost DSR and energy storage as it will allow them to compete with traditional generation in the provision of this vital service to the System Operator, National Grid. Professor Goran Strbac of my almer mater Imperial College has frequently spoken about the potentially huge benefits that energy storage assets could provide to the BM, so this development would pave the way for his predictions to become reality.

Removing barriers to smart meters and “time of use” tariffs

The document refers to the UK Government’s commitment to ensuring that every household and small business is offered a smart energy meter by the end of 2020.

To make the most of these hard assets, domestic half hourly settlement of electricity payment has been possible on an elective basis since June 2017 and Ofgem will consult on whether it will be made mandatory. If so, it would be dovetailed to coincide with the smart meter roll-out.

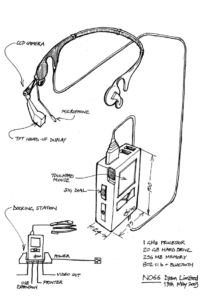

Intriguingly, these two developments would allow me to introduce my PowerCube product idea if I decided to move forward with it, as the smart meter and half hourly metering requirements were the two major limiting factors holding back the product’s successful launch.

The document talks about the need for consumer protection, standards, and cybersecurity protection as part of the smart energy revolution. In an increasingly interconnected and rapidly-changing world, these factors will be extremely important if the benefits are to be safely secured.

Recognition of smart energy entrepreneurship

On a final note, it was great to see the inset case studies of various innovative smart energy startups such as VCharge and Open Utility included in the paper.

It was particularly great to see Upside Energy mentioned, which is a company that formed as part of the Nesta Dynamic Demand Challenge competition that I supported as a mentor back in 2014. Graham and the team were one of the winners, so it’s encouraging to see them still going from strength to strength.